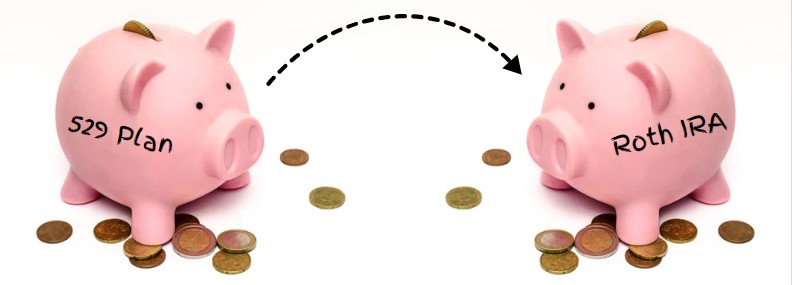

Your children have graduated college, started their first jobs, and are on their way to becoming financially independent. You realize that there are still funds left in the 529 account that you started for them 2 decades ago. But that money was for their education and you can't move it without a penalty. What to do?

View More

.jpg)